You're receiving this because you signed up on our website. Want to unsubscribe? Just reply to this email with the words “no thanks.”

First-time reader? Join {{active_subscriber_count}} other seniors for free.

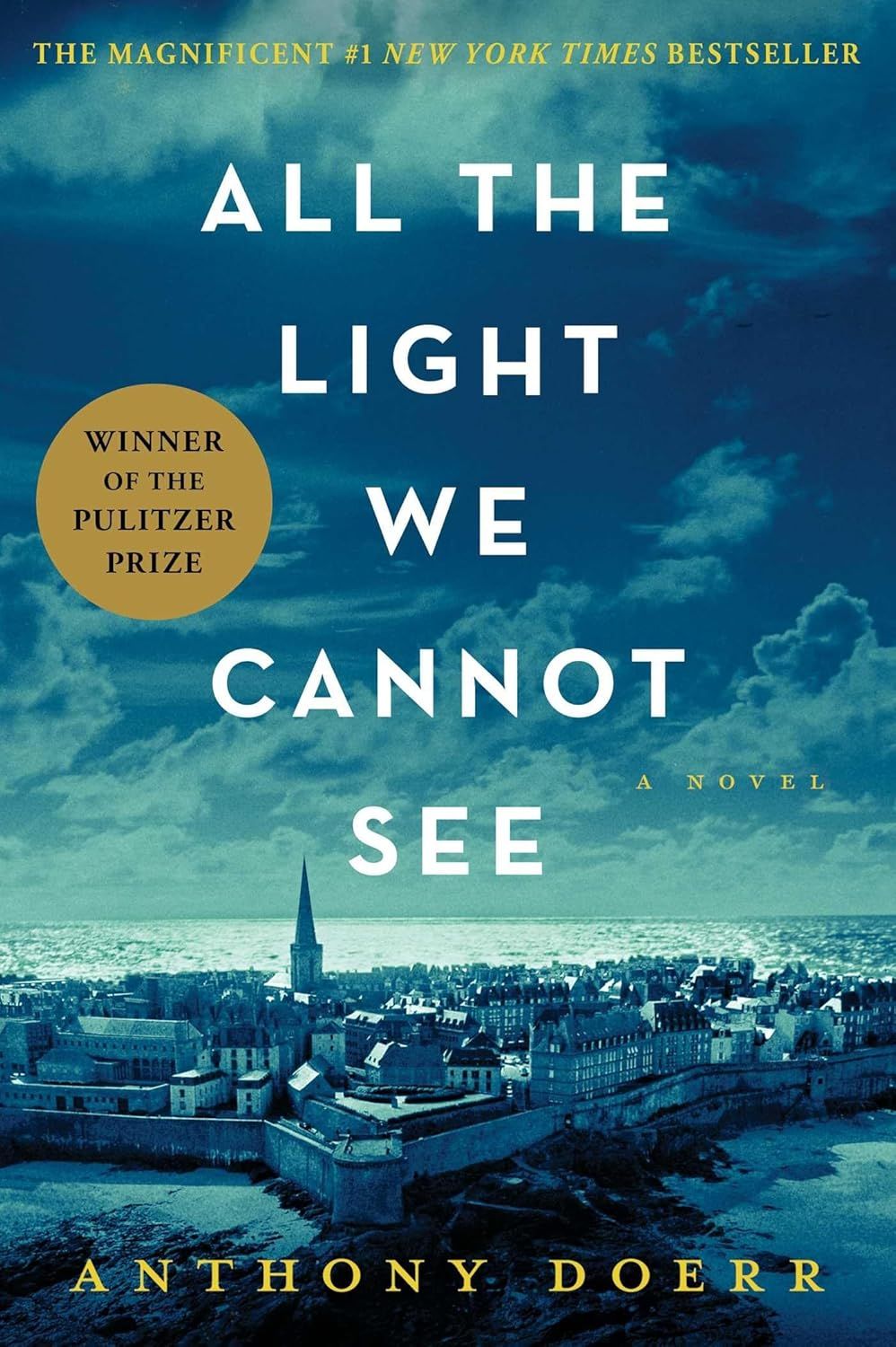

Book of the Day

All the Light We Cannot See

Anthony Doerr

In All the Light We Cannot See, Anthony Doerr entwines the paths of Marie-Laure, a blind French girl hiding secrets, and Werner, a brilliant German boy bound by duty, as World War II’s shadows descend on Saint-Malo. Through shimmering prose and short, haunting chapters, the novel reveals how acts of courage and resistance—no matter how small—can ignite the unseen light between unlikely souls.

Find it here

Facing a problem? Seniors Magazine can help for free.

If you want help solving a problem, just reply to this email and share a few details (don’t include private medical info or specific financial details like your SSN).

We will help solve your problem for free (our partners may offer you paid services, but there’s no commitment).

(How do we fund Seniors Magazine solving problems for free? We sometimes get paid for making introductions to reputable providers.)

Here are examples of problems we help with, each with local or national solutions and many offering free consultations:

📈 Managing investments/auditing portfolios

🏥 Finding health insurance options, finding providers, or consolidating fragmented medical records

💰 Improving personal finances with budgeting consultations

🏘️ Finding a retirement community

🏃 Finding a fitness coach who supports seniors over video

🛠️ Remodeling, or modifying a home to age in place

🧹 Home maintenance (lawn care, handyman, etc.) beyond remodeling

👩⚕️ Establishing home health care

🚗 Transportation to and from appointments

💌 Feeling lonely and wanting a pen pal

💻 Tech help (lessons or troubleshooting)

📜 Needing a trust or will

🎖️ Benefits advocacy (e.g., chasing down veterans’ or SSN benefits)

🌳 Genealogical research

✍️ Writing your memoir ⬅ our favorite!

🧸 Writing and illustrating a children's book

📚 Publishing or promoting a book you’re writing

✈️ Planning your next vacation (selecting a spot, booking tickets)

🐾 Pet care

Don’t tackle life without support. Just reply to this email and tell us what you need. It’s free for you; you’ll only pay a service provider if they have what you’re looking for.

How to Save on Prescription Medications

Prescription costs can add up quickly, especially if you’re managing multiple health conditions. The good news is there are safe and reliable ways to reduce expenses without sacrificing quality of care. Here are some options to explore.

1. Ask About Generics

Basic: Many brand-name drugs have generic equivalents that work just as well but cost far less. Ask your doctor or pharmacist if a generic is available.

Advanced: If no generic exists, request a “therapeutic alternative” in the same drug family that may be more affordable.

2. Compare Pharmacy Prices

Basic: Prices vary from one pharmacy to another. Use free tools like GoodRx to check local prices before filling your prescription.

Advanced: Mail-order pharmacies (often through insurance plans) can offer 90-day supplies at lower costs.

3. Review Your Insurance Plan

Basic: Make sure your prescriptions are on your plan’s formulary (the covered list of drugs). If not, ask your provider about alternatives.

Advanced: During Medicare open enrollment, compare Part D or Medicare Advantage plans to ensure your medications are covered at the best rates.

4. Look for Manufacturer and Pharmacy Discounts

Basic: Many drug manufacturers provide savings cards or coupons for eligible patients.

Advanced: Some pharmacies offer membership discount programs that can reduce costs beyond insurance coverage.

5. Talk to Your Doctor About Dosage Options

Basic: Sometimes, higher-dose tablets can be safely split (with a doctor’s approval), reducing overall costs.

Advanced: Ask about extended-release versions, which may reduce how often you need to take (and refill) your medication.

6. Use Assistance Programs

Basic: Nonprofits and state programs often help cover medication costs for those who qualify.

A little research and open communication with your healthcare providers can lead to meaningful savings. Small changes—like switching to generics or comparing pharmacy prices—can make a big difference over time.

💌 If you know someone who’s struggling with prescription costs, share this with them. Saving money on medications can ease stress and improve health at the same time.

On Health

Healthy recipe: Ham and White Bean Soup

Helpful health gadget: Squeeze Balls for Hand Therapy

On Finances

Useful financial product: EverSafe monitors your financial accounts for signs of fraud or unusual activity, and alerts you (and trusted contacts) so you can act fast.

Quick Poll (vote to see the anonymized current results)

Do you use online banking or financial apps?

Grandkids Corner

How to Choose the Right Musical Instruments for Your Grandkids

Introducing your grandkids to music can be one of the most rewarding gifts. But with so many instruments available, how do you know which one is right? The best choice depends on their age, personality, and level of commitment.

Basic: Simple Guidelines for Getting Started

Match the Instrument to Their Age

Ages 3–6: Start small with simple instruments like a ukulele, keyboard, hand drums, or even a recorder. These are affordable, easy to handle, and build confidence.

Ages 7–10: At this stage, children can usually manage guitar, piano, or violin lessons. These instruments also form the foundation for many other musical paths.

Ages 11+: They can begin exploring band instruments like flute, trumpet, saxophone, or drums.

Consider Personality

Outgoing, energetic kids often enjoy drums or brass instruments.

Thoughtful or detail-oriented kids may prefer piano or violin.

Budget and Space

Start with entry-level instruments before investing in professional ones.

Consider the size of the instrument—an upright piano may not fit in every home, but a keyboard can.

Advanced: Helping Them Grow with the Right Support

Try Before You Buy: Many music stores rent instruments or offer short-term trials. Renting helps you avoid expensive purchases if your grandchild changes their mind.

Teacher Recommendations: If your grandchild has a school music program or private teacher, ask for input before purchasing.

Instrument Quality: Even for beginners, avoid toy-quality instruments. A poorly tuned violin or stiff keyboard can discourage learning. Look for reputable starter brands like Yamaha (for keyboards) or Fender (for beginner guitars).

Encourage Exploration: Let them test different instruments before committing. Sometimes the “wrong” choice leads to discovering what excites them most.

Digital Options: If space or noise is a concern, digital pianos with headphones or electronic drum kits are excellent alternatives.

On Tech for Seniors

How to Use Online Banking Safely

Online banking can save you trips to the branch and make managing money much easier, but safety is key. With the right precautions, you can enjoy the convenience without worrying about fraud.

Basic: Essential Safety Tips

Go Directly to Your Bank’s Website

Don’t click on links in emails or texts. Instead, type your bank’s web address directly into your browser or use the official banking app.Use Strong, Unique Passwords

Create a password that’s at least 12 characters long and includes numbers and symbols. Don’t reuse the same password for multiple accounts. Consider using a password manager like 1Password or LastPass.Enable Two-Factor Authentication (2FA)

Most banks offer this extra layer of protection. It usually means you’ll receive a code by text or app when you log in.Check for the Lock Symbol

When you visit your bank’s website, make sure the web address begins with https:// and shows a lock icon. This means the connection is secure.Avoid Public Wi-Fi

Never log in to your bank account while on public Wi-Fi at cafes, airports, or hotels. Use your home network or your phone’s data connection.

Advanced: Extra Protection for Tech-Comfortable Users

Use a Dedicated Device: Some seniors choose to use a separate tablet or laptop just for banking and bill payments, reducing exposure to malware.

Set Up Alerts: Most banks let you set text or email alerts for large withdrawals, purchases, or login attempts. This helps you spot fraud quickly.

Keep Software Updated: Make sure your browser, banking app, and antivirus software are always updated to the latest version.

Freeze Your Credit: For added protection, you can place a free credit freeze with the three major bureaus (Equifax, Experian, TransUnion). This blocks new accounts from being opened in your name.

Use a VPN: If you travel often, a Virtual Private Network like NordVPN can secure your connection when you must use public Wi-Fi.

Fashion Over Fifty

Talbots – Mixed Cable Shawl Collar Sweater (approx. $100)

Ann Taylor – Mixed Media Pleat Front Top (approx. $78)

Everlane – The Organic Cotton Box-Cut Pocket Tee (approx. $23)

Boden – Ada Linen Midi Dress (approx. $138)

Marks & Spencer – Printed V-Neck Tie Front Midi Dress (approx. $135)

Unscramble

Unscramble the letters to find a famous person, event, or object! Be the first to reply with the correct answer, and we’ll send you a free gift in the mail.

Today’s clue: Baked one-dish meal that often shows up at gatherings.

ORACSELES

Want to Earn in Retirement?

Help a life story get told, earn thousands: Refer someone to MemoirGhostwriting.com and earn 12% of what they spend. Find out more here

Disclaimer: Some links in this newsletter are affiliate links. If you make a purchase through them, Seniors Magazine may earn a small commission at no extra cost to you. The content of the newsletter is for informational purposes only and should not be taken as financial, legal, or health advice. We may also share polling responses with advertisers to help keep this newsletter free.